Let’s start with the forex market and examine some key components.

The forex market is the biggest financial market in the world, with a daily trading volume of around $6.6 trillion.

It is traded over the counter, meaning no centralised exchange is involved. Instead, it’s directly between two parties.

The only commodity in the forex market is money. This means traders buy and sell various currencies – exchanging one for another – and the stock market determines the price of each currency.

However, more factors can influence the price of various currencies, but more on that later.

We saw that the forex market is the biggest financial market globally, but the stock market is the oldest and most popular financial market.

The stock market is where traders and investors buy and sell publicly traded companies’ shares (units of ownership). There are two categories within stocks: blue-chip stocks and penny stocks.

Blue-chip stocks represent some of the world’s most established companies with large market capitalisations, such as Google, Microsoft, Apple, and Amazon.

On the other hand, Penny stocks are smaller publicly traded companies with a share price of less than one dollar. If successful, penny stocks could be beneficial in the long term for those who want to take a risk on a speculative investment.

Stock market traders and investors are known to apply the buy-and-hold method to operate in a volatile market. This means they will hold their positions for several days up to a few months.

This approach helps guide traders and investors in evaluating the fluctuations in volatility to avoid evident risk.

Other financial assets investors and traders can consider within the stock market include bonds, ETFs, and indices.

Market trading hours

When looking at trading forex vs stocks, one of the first things to consider is the time you’ll need to be in front of the charts.

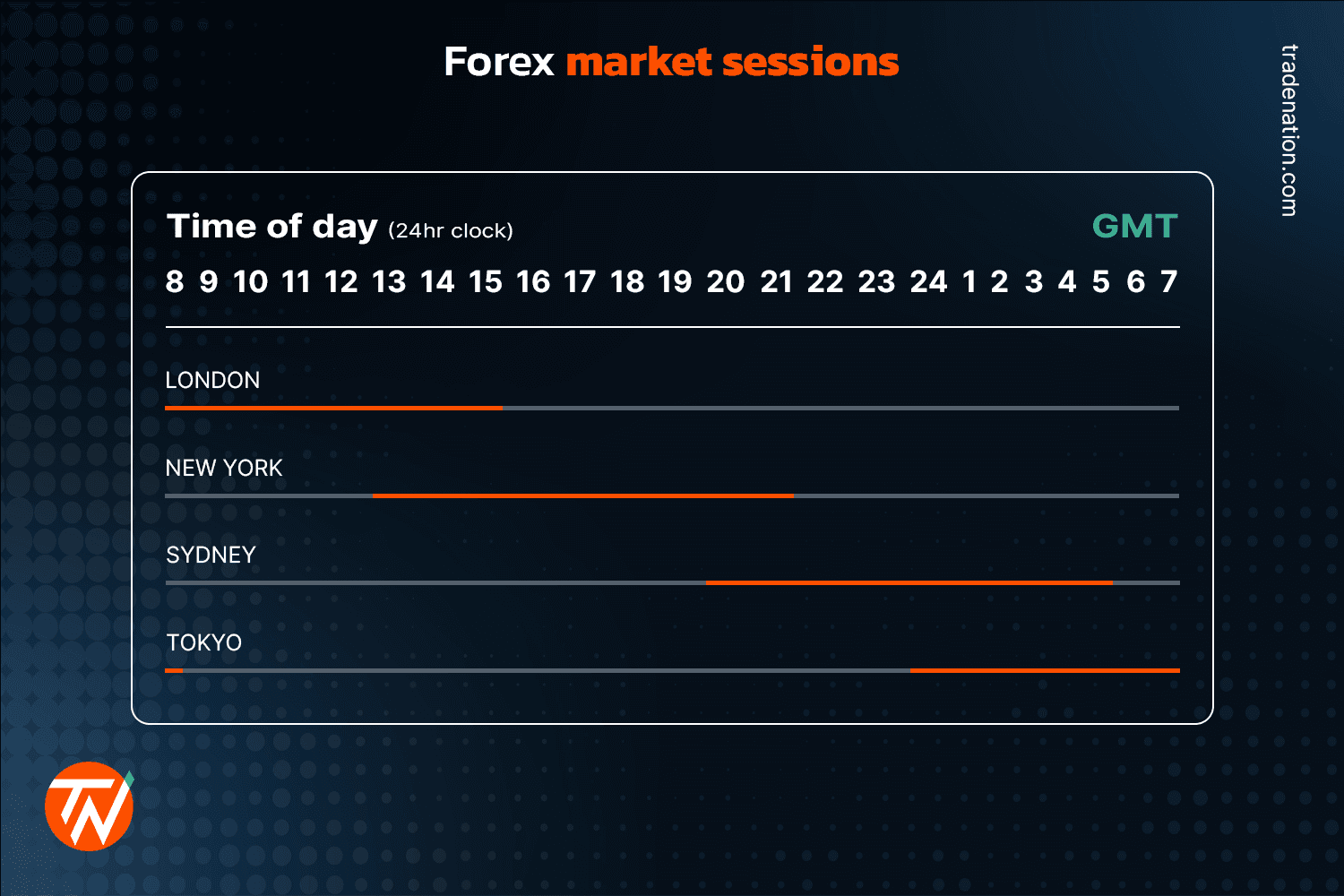

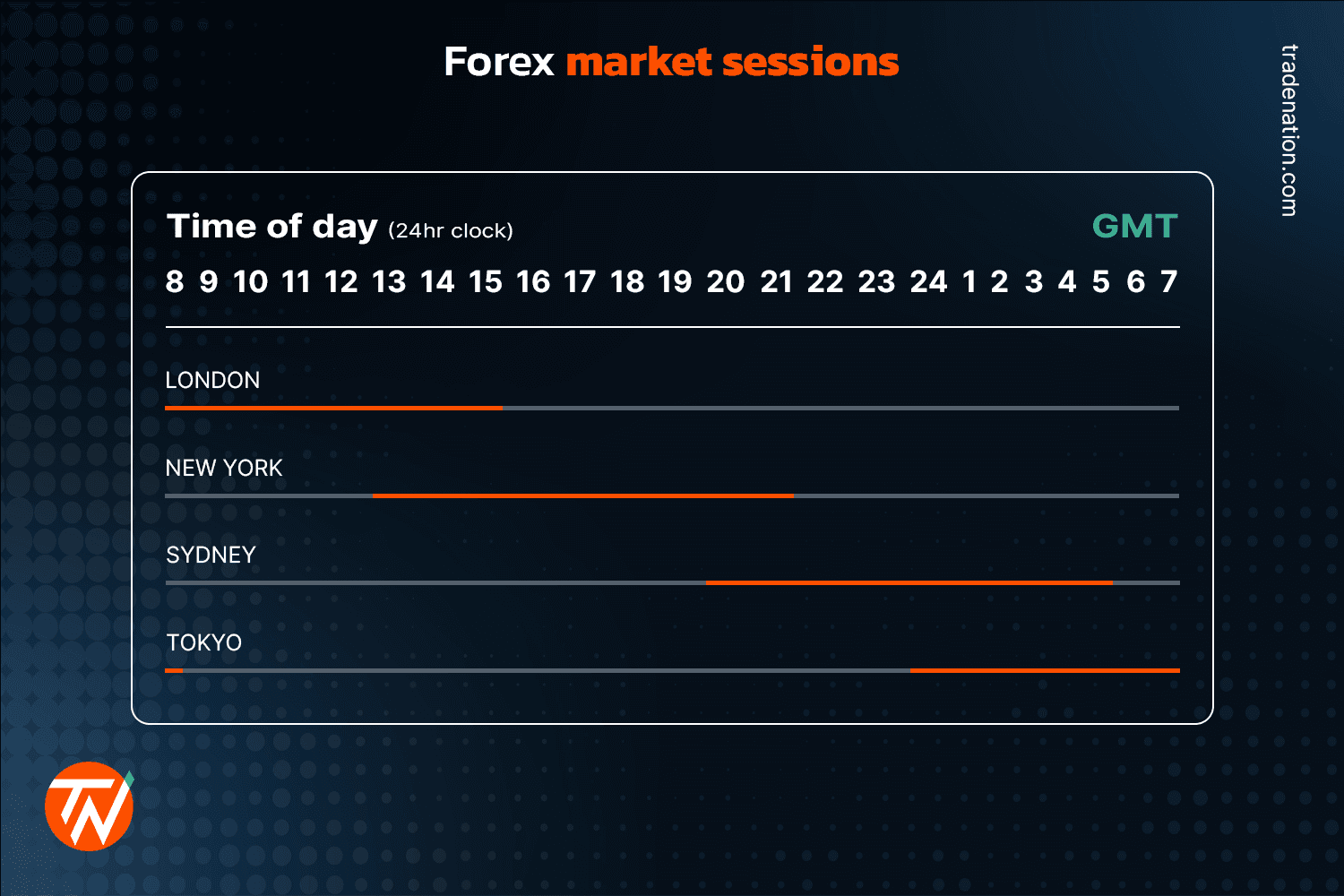

The forex market is 24/5, which means it operates 24 hours a day, five days a week.

The world has four main financial centres where the market is conducted and maintained: Sydney, Tokyo, London, and New York. The order in which the forex market hours move is Sydney, Tokyo, London, and New York.

The remarkable aspect of the four centres’ different time zones is that investors and traders can be active in the market around the clock, from Sunday at 22:00 GMT when Sydney opens to Friday at 21:00 GMT when New York closes.

As we mentioned, the positive aspect of this is that it provides you with many opportunities to trade. However, there is a risk involved in the markets moving when you’re unavailable to monitor it.

It’s worth noting that the best time to monitor the markets for trades is when they’re most active. It’s usually when two markets overlap due to many market participants buying and selling, increasing liquidity and speeding up transactions.

For instance, if you’re looking to trade GBP/USD, you’ll consider the hours between 12:00 and 16:00 London time, which overlap with those in New York.

Now, the stock market takes a different approach to its trading hours. It limits the listed stocks to the exchange’s hours.

For instance, the London Stock Exchange operates between 08:00 and 16:30 GMT and overlaps with the New York Stock Exchange, which opens from 14:30 to 21:00 GMT.

Some exchanges are known to close for a lunch break, but that’s more in the Asia-Pacific region. However, the London Stock Exchange also closes for a lunch break for two minutes only.

Lastly, it’s important to remember that no financial market is open during the weekend.

Liquidity & volatility

Liquidity is how quickly a trader can buy or sell an asset in the market. It’s a crucial factor to consider because the more traders participate in the market, the more money flows. This will bring down an asset’s trading cost, allowing traders to open and close positions quickly without worrying about the effect on the price.

The liquidity within the market can change during the day as different sessions open and close. Depending on the forex pair you choose to trade, you’ll also find that some will have more liquidity than others. For instance, the major forex pairs see more price fluctuation compared to minor or exotic pairs.

Since the stock market doesn’t see as many trades per day as the forex market, liquidity is much lower. However, shares remain easy to invest in or trade.

Blue chip stocks, as previously mentioned, are the most popular stocks and have higher liquidity because there are more buyers and sellers, whereas if you move away from those stocks, you’ll start to see a drop in liquidity.

Volatility measures how quickly price changes take place in the market.

If a market is highly volatile, the price changes will happen quickly, whereas if a market has low volatility, prices tend to change more gradually.

The forex market is highly volatile. This is because of the many market participants, which can cause prices to change quickly. However, the market participants aren’t the only factors to consider. It would be best to keep an eye out for economic, social, and political events.

These events are known for causing prices to make sudden changes, sometimes in extreme fashion.

On the other hand, the stock market is more stable, with low volatility, making it easier to track prices. But, as it’s still a financial market, it can see moments of high volatility, just like forex, especially in domestic politics.

An excellent example is what happened in March 2018, when US President Donald Trump’s trade tensions with China caused the Dow Jones price to fall.

source: https://www.cnbc.com/2018/06/19/us-stock-futures-trade-tensions-in-focus-for-investors.html

Focusing on volatility trading can potentially provide traders with opportunities to profit. However, it is highly risky and best left alone for traders and investors with vast experience.

Volume of assets

As mentioned, the forex market is the biggest financial market globally, with a daily volume of over $6.6 trillion. There are hundreds of currency pairs to choose from, which fall into three currency categories: majors, minors, and exotic.

Within those categories are different varieties of currency pairs; however, most traders only focus on the most popular pairs, which include EUR/USD, GBP/USD, USD/JPY, and AUD/USD.

The sheer volume of trades taking place in the forex market makes it difficult for the stock market to keep up.

To give you a better insight, the stock market only has a daily volume of around $200 billion. Even though its volume is lower than that of the forex market, the stock market has a broader variety of trading instruments.

Let’s take the New York Stock Exchange as an example. They have over 2400 stocks with categories in 11 sectors; this includes energy, financials, technology, healthcare, materials, consumer staples, real estate, utilities, etc.

Even though the stock market has more trading instruments than forex, most traders prefer trading a small number of forex pairs with a long history of steadiness instead of investing in new, emerging, or existing stocks.

Market Influences

Market influence is a crucial part to consider when trading forex vs stocks. In essence, both stocks and forex are influenced by supply and demand.

However, there are many more factors to consider. Let’s start with stocks.

When trading stocks, you’ll need to look at anything that directly influences the company of the stock you are trading. These include the company’s earnings, cash flow, and debt levels.

Outside factors can consist of the health of the company’s industry, news reports, and/or economic data.

Now, when trading forex, the influences you’ll need to monitor are much more comprehensive because you’re dealing with currencies from different countries.

You’ll need to examine a country’s macroeconomics, which can include data on inflation, GDP, unemployment, and political events.

But remember, forex currencies always trade in pairs, so you’ll need to consider both countries whose currencies you’re trading.

Leverage

Leverage makes trading possible for anyone because you’ll only need a fraction of the capital generally required as a deposit or margin.

Spread betting or CFDs, allows the trader to trade on margin across various markets using only a small percentage of the actual trade value. Such an advantage is known to both the forex and stock market; however, forex trading is more widely known for its use of leverage.

To put this in perspective, the stock market generally allows for a much lower leverage ratio. In contrast, the forex market allows for much higher leverage ratios and depends on the regulator’s tolerance.

But even though a trader could make big gains using leverage, it’s just as easy for traders to make significant losses, which can result in blowing your account.

Whether you choose the forex or stock market doesn’t matter. What matters is being aware of the risk and how much of your account you want to expose.

Trading strategies

As mentioned above, the rise of technology has substantially influenced the investment industry. There is a wealth of knowledge and resources available for investors and traders. Most of the knowledge you’ll find are multiple strategies you could apply to your trading style.

Suppose we take stock trading; the strategies investors and traders follow are more long-term based. This means that they will look at quality stocks that are more likely to appreciate in value over time, giving them substantial profits.

They will look at various market influences (see under Market Influence) to gather all the information required to make the best possible decision. Two other strategies for stock traders include dividend investing and IPO investing.

On the other hand, the forex market offers traders numerous trading strategies. Most of these strategies are short-term, meaning traders look for small price movements in the market.

These small changes in price movement, together with leverage, can cause some traders to make considerable profits on their accounts. Some of the most popular strategies forex traders use are swing trading, day trading, and scalping.

Traders and investors can incorporate each of these strategies with other strategies, such as news trading, trend trading, and breakout trading.

Technical analysis is at the heart of these forex trading strategies.